Tag : News

- Clipperton acted as sole financial advisor to vLex. The award-winning online subscription platform offering easy access to the largest collection of legal information in a single service welcomes the pan-European private equity investor Oakley Capital to its capital.

- This new partnership is fueled by a joint commitment to deliver world-class legal technology to a global market worth $21bln.

About the transaction

- vLex was founded in 1998 by the brothers Lluís and Angel Faus and is headquartered in Barcelona, London and Miami. The company provides a cutting-edge service for thousands of lawyers, law firms, government departments, and law schools around the world.

- It is the only legal content vendor operating at a global scale, providing case law, legislation and secondary sources from 100+ countries on a single platform.

- vLex’s scalable and smart data ingestion process, coupled with AI-powered search engine functionality, simplifies research and analysis, increasing productivity for users.

- vLex is profitable and has consistently generated double-digit revenue growth in recent years thanks to strong management, a differentiated product offering, and market tailwinds. The global Legal Tech market is worth $21 billion and growing as legal information users digitalize their business models further, amid the growing complexity and internationalization of laws and regulations.

- The investment will be made through the Oakley Capital Origin Fund.

- Oakley’s latest investment will help vLex’s management accelerate its strategic goal of building a cost-effective leader in the fragmented market for legal research, through organic growth and M&A.

Clipperton’s latest transactions in Spain

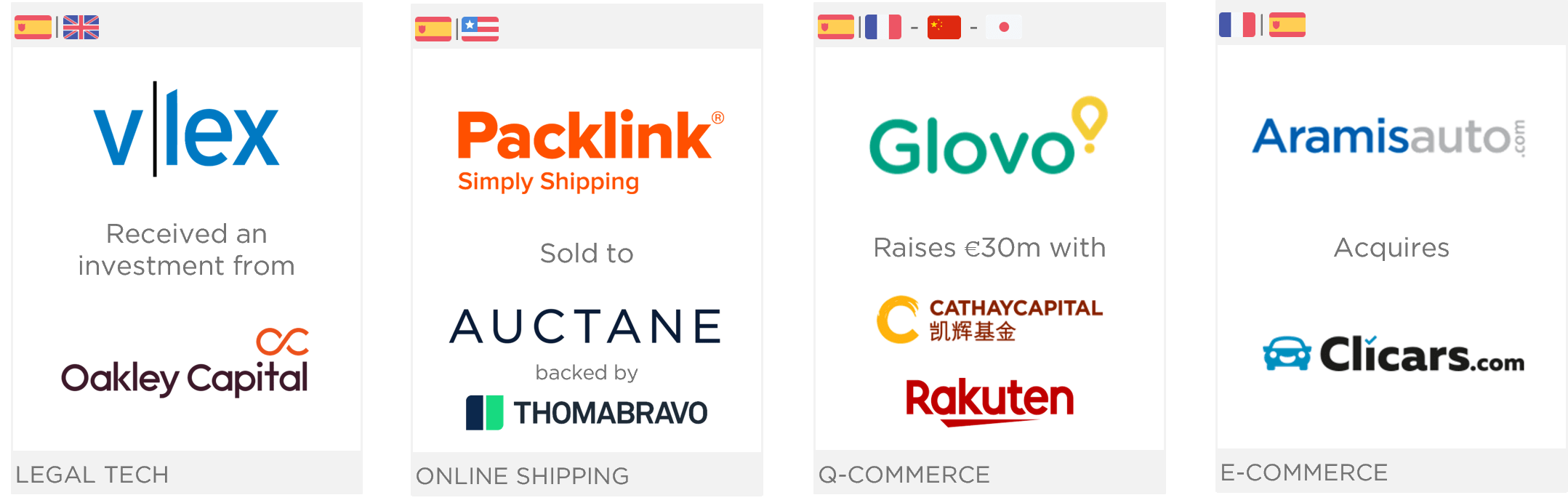

This deal is testimony to Clipperton’s increased activity in the Spanish market, by advising two sell-side deals with Spanish clients in the past 6 months (vLex and Packlink).

Looking back at Clipperton’s Tech Event in Madrid in Q1-2022

Clipperton and Endeavor organized an event in Madrid on February 9th 2022. The Spanish tech ecosystem is experiencing strong growth dynamics with a robust funding environment, including several mega-rounds. Clipperton and Endeavor hosted a session on how founders contemplating the sale of their company prepare and execute their exit.

Recent track record of Growth Buy-Out deals for SaaS companies

This deal confirms Clipperton’s extensive expertise within the SaaS sector and with buy-out mandates, with recent transactions such as Ecovadis’s $500m growth financing led by Astorg, Carlyle’s $70m investment in Inova Software, and MBO & Co’s growth investment in Praxedo.

Deal Team

- Thibaut Revel, Managing Partner

- Antoine Ganancia, Partner

- Olivier Combaudou, Executive Director

- Wael Abou Karam, Vice President

- Nathan Burnel-Hauteville, Analyst

About Clipperton

Clipperton is a leading investment bank dedicated to technology and growth companies. We provide strategic and financial advisory to entrepreneurs, corporates, and top-tier investors in Europe willing to execute transactions such as strategic M&A, private equity transactions, and private placements. Founded in 2003 and with offices in Paris, Berlin, Munich, London, New York, and Beijing, Clipperton has completed over 350 M&A and private placement transactions with fast-growing technology start-ups, blue-chip corporates, and renowned financial investors.