- Clipperton acted as sole financial advisor to Reporting 21 (formerly Sirsa), a leading sustainability-focused SaaS platform, on its sale to Cority, a portfolio company of Thoma Bravo.

- This transaction will allow both companies to pursue their mission to empower organizations – both corporates and financial institutions – globally to operate more responsibly, make better decisions and take action.

Our client

- Established in 2014, Reporting 21 offers an innovative Environmental, Social, and Governance (ESG) performance solution and expert advisory services to help financial institutions and corporations accelerate their path to sustainability by developing and managing their ESG data and programs.

- Reporting 21 has over 150 clients in both the corporate and financial institution segments, including among others BlackRock, L’Oreal, Eurazeo, and UBS.

- With over 70 employees, Reporting 21 is used by thousands of users in over 120 countries.

- The company was backed by Capza, Andera Partners and Raise.

Deal Rationale

- With over 30 years of history, Cority is a leading global enterprise Environmental, Health, and Safety (EHS) software provider, with over 2.5 million end users using its platform.

- The acquisition of Reporting 21 will “enable Cority to serve a broader spectrum of customers and provide the right sustainability and ESG solution for every organization globally”, said Mark Wallace, CEO of Cority.

- By acquiring the leading European player addressing finance clients, Cority is strengthening its footprint in Europe, cementing its leading position and will continue to invest in the company’s product portfolio.

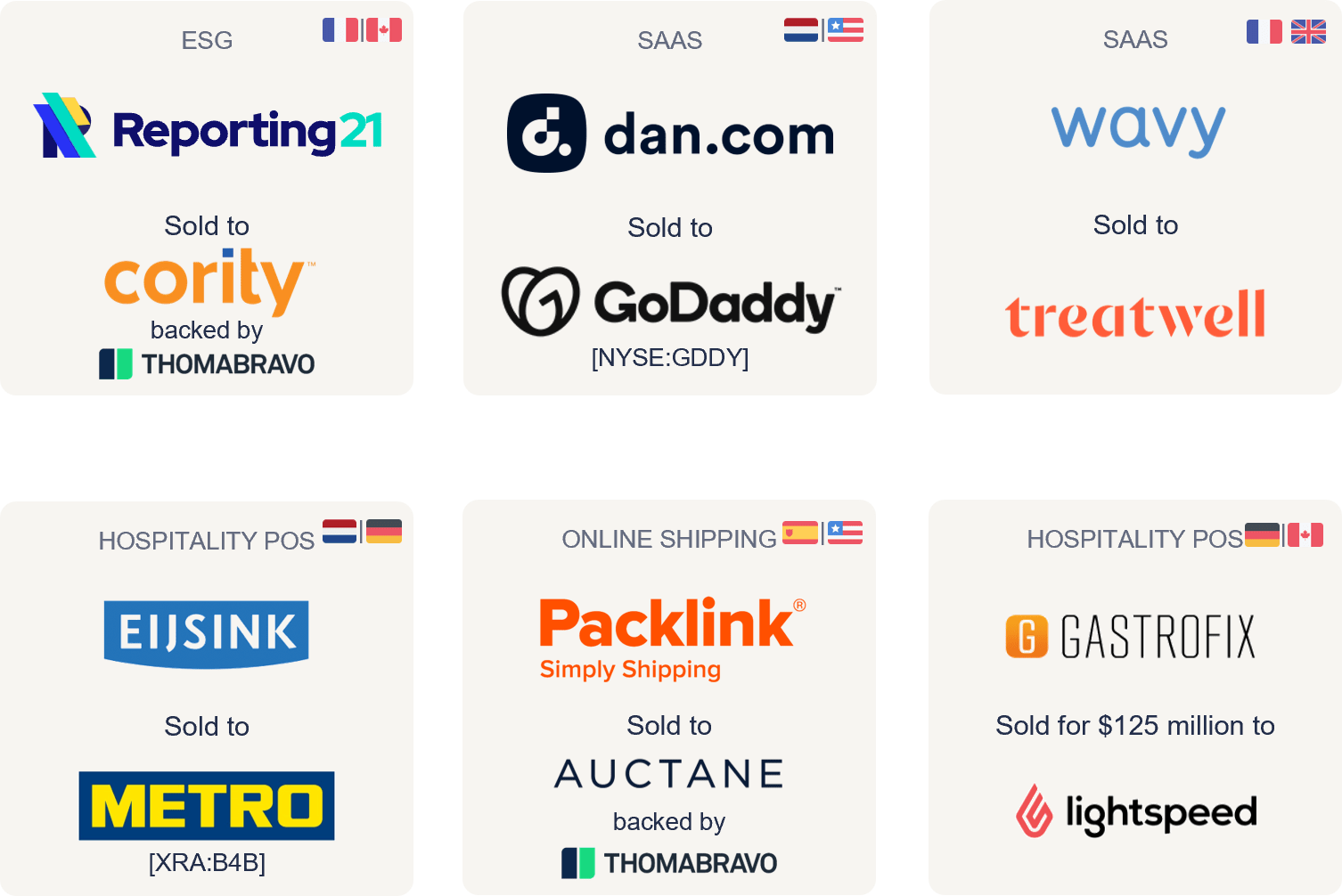

Successful track record of finding international acquirers for European SaaS companies

| This transaction further illustrates Clipperton’s unique ability to find international acquirers for European SaaS companies – including the sale of Dan to GoDaddy, the sale of Wavy to Treatwell or the sale of Thoma Bravo’s portfolio company Auctane. |

Deal Team

- Nicolas von Bülow, Managing Partner

- Nicolas Segretain, Managing Partner at Natixis Partners

- Marc Schäfer, Director

- Nathan Burnel-Hauteville, Analyst

- Elie Hodara, Analyst

About Clipperton

Clipperton is a leading investment bank dedicated to technology and growth companies. We provide strategic and financial advisory to entrepreneurs, corporates, and top-tier investors in Europe willing to execute transactions such as strategic M&A, private equity transactions, and private placements. Founded in 2003 and with offices in Paris, Berlin, Munich, London, New York, and Beijing, Clipperton has completed over 350 M&A and private placement transactions with fast-growing technology start-ups, blue-chip corporates, and renowned financial investors.