One of the most significant M&A transactions in logistics technology in Europe in 2021: Clipperton acted as sole sell-side financial advisor to Packlink, its management and shareholders (a.o. Eight Roads, Accel and Active Venture Partners) on its sale to Auctane, a US-based leader in fulfilment software (recently acquired by Thoma Bravo).

Executive Summary

- Packlink is Europe’s leading multi-carrier SMB shipping company connecting more than 250K online merchants with over 80 carriers globally. The company has been acquired by Auctane, a US-based leader in fulfilment software, which operates trusted brands like Stamps.com, ShipStation, ShipEngine, MetaPack, and Endicia.

- This transaction is one of the most significant M&A deals in the tech-enabled logistics/online shipping space.

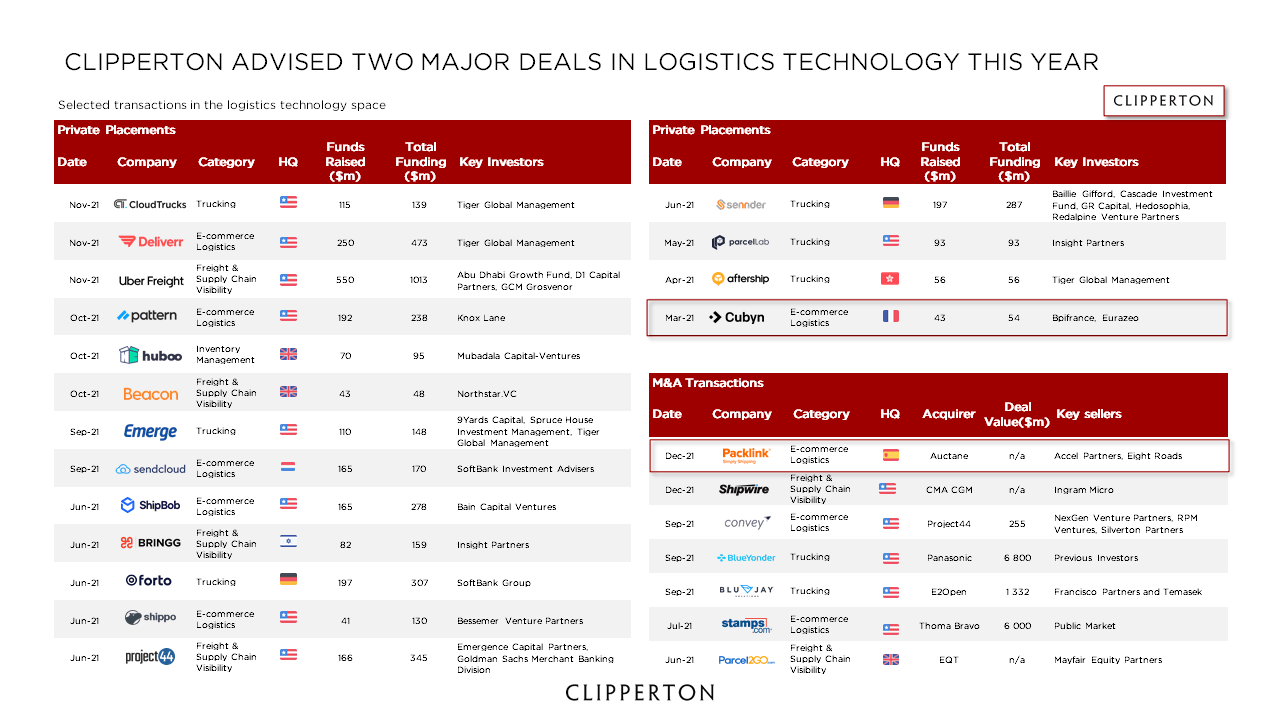

- The transaction confirms Clipperton’s unique expertise in the logistics technology space after successfully advising Cubyn in 2021 on its round led by Eurazeo and Bpifrance, as well as Boxtal and Glovo.

Our Client

- Packlink is Europe’s leading multi-carrier SMB shipping platform connecting more than 250K online merchants with over 80 carriers globally, enabling access to competitive shipping tools. It partners with major global e-commerce platforms and marketplaces such as Paypal or eBay.

- Founded in 2012, Packlink offers individuals and business customers a fast and easy way of booking parcel deliveries with the world’s top couriers.

- Headquartered in Madrid, the company operates in 12 countries across Europe.

- The company has raised $23.5m with tier-one investors such as Accel Partners, Eight Roads Ventures, and Active Venture Partners.

Our View on the Logistics Sector

- The logistics industry is experiencing robust and secular growth momentum with a radical acceleration through the Covid-19 pandemic creating ten years of eCommerce penetration growth in 3 months and 150 million new digital shoppers.

- This paradigm change has created a sharp increase in parcel shipping and delivery, exceeding 115 billion parcels in 2020, and is expected to double in the next four years.

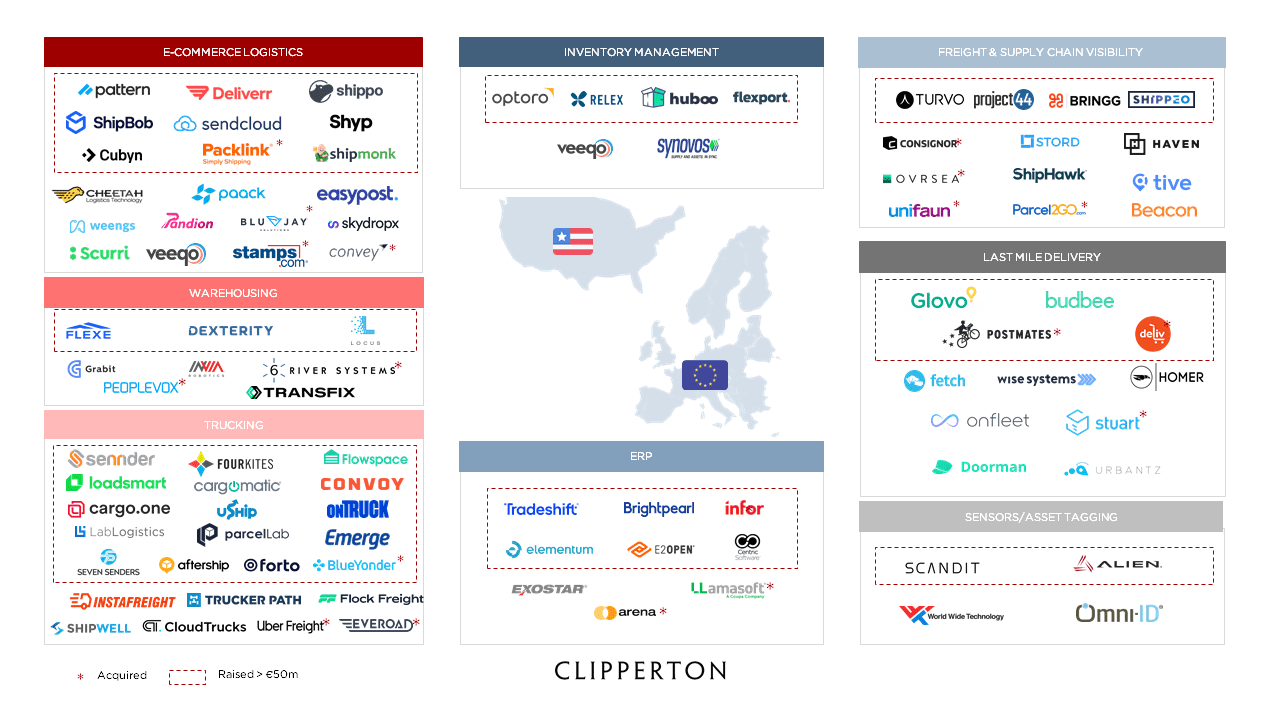

- In this context, the ongoing reshaping of the supply chain and logistics ecosystem is accelerating, creating tomorrow’s champions on all sub-segments of the industry:

- As a consequence, the industry has moved into the spotlight, attracting unprecedented financial investor interest and with many landmark transactions announced recently.

- This trend is set to accelerate with the increasing involvement of global private-equity investors entering the space and following clear build-up strategies, starting with the acquisition of Auctane by Thoma Bravo who acquired Packlink after the take-private transaction.

Packlink x Auctane: Deal Rationale

- Packlink’s acquisition by Auctane, a US leading player, is a landmark deal and one of the most significant M&A transactions in the European logistics technology industry in 2021.

- Auctane is a US-based leader in fulfilment software, which operates trusted brands like Stamps.com, ShipStation, ShipEngine, MetaPack, and Endicia, backed by Thoma Bravo, a leading global private equity firm focused on software and technology with over $83 billion in assets under management.

- The acquisition of Packlink by Auctane follows an ambitious external growth strategy after five acquisitions in the past seven years (inc. Metapack, Shipping Easy, Endicia, Shipworks, Shipstation).

- By acquiring the leading player in Europe, Auctane is immediately strengthening its footprint in the European SMB market segment.

Process Highlights & Clipperton’s Role

- Clipperton was appointed as sole sell-side financial advisor by Packlink’s management and current shareholders (a.o. Eight Roads, Accel and Active Venture Partners).

- Clipperton’s mission consisted in leveraging existing inbound interest as well as driving a compact, competitive process involving strategic and PE parties and giving optionality to shareholders between a large growth equity round and a trade sale to a strategic.

- Significant interest and competitive tension allowed Packlink’s shareholders to obtain strong offers from multiple parties.

- This transaction confirms Clipperton’s unique expertise in the logistics space after successfully advising Cubyn in 2021 in a €35m round led by Eurazeo and Bpifrance, as well as Boxtal and Glovo (Series B of €30m in 2017).

- This deal also demonstrates Clipperton’s ability to support European category leaders in their transactions with tier-one and cross-border counterparts (latest transactions: Sendinblue’s $160m growth equity funding led by Bridgepoint, Bpifrance, and Blackrock, Withings’ $60m round led by Gilde Healthcare, Idinvest Partners and Bpifrance and Gastrofix’s sale to Lightspeed POS Inc. (TSX: LSPD) for a total consideration of $125m).

- Packlink CEO Ben Askew-Renaut stated: “We are thrilled to join Auctane. […] Auctane shares our vision of facilitating online shipping worldwide. Together, we offer a broader selection of global delivery capabilities to the e-commerce partners and merchants who trust us to power their shipping.” He further added: “We selected Clipperton as an investment bank for its tech expertise, track-record, and broad global access to strategic counterparts. We were amazed by the outstanding advisory work of Clipperton during this focused process, which was conducted fully remotely, and we are delighted with the outcome.”

- Nicolas von Bülow, Managing Partner at Clipperton, stated: “We are delighted to have supported Ben Askew-Renaut and his team in the next phase of the company’s growth. We believe that with Auctane, Packlink has found the best possible partner to continue its outstanding development.”

Deal Team & Enquiries

- Nicolas von Bülow, Managing Partner, nvonbulow@clipperton.com

- Dr. Nikolas Westphal, Partner, nwestphal@clipperton.com

- Antoine Ganancia, Partner, aganancia@clipperton.com

- Marc Schäfer, Director, mschafer@clipperton.com

- Milan Amalou, Vice President, mamalou@clipperton.com

- Christopher Kertess, Associate, ckertess@clipperton.com

- Alexandra Dubar, Analyst, adubar@clipperton.com

Click here to access the German press release.

Click here to access the Spanish press release.

Click here for a list of our recent transactions.

About Clipperton

Clipperton is a leading investment bank dedicated to technology and growth companies. We provide strategic and financial advisory to entrepreneurs, corporates, and top-tier investors in Europe willing to execute transactions such as strategic M&A, private equity transactions, and private placements. Founded in 2003 and with offices in Paris, London, Berlin, Munich, New York, and Beijing, Clipperton has completed over 300 M&A and private placement transactions with fast-growing technology start-ups, blue-chip corporates, and renowned financial investors.