- Clipperton acted as sole financial advisor to Kinvent, the European leader in connected physiotherapy solutions, on its €16m growth financing led by Eurazeo Healthcare fund (Nov Santé), with the participation of existing minority shareholders including Unifund, Sofilaro, BADGE, and Raphaël Varane, among others.

- This is the third round of fundraising and will enable the company to enter a new phase of acceleration, including market penetration in the United States in 2024 and increased effort on new R&D projects.

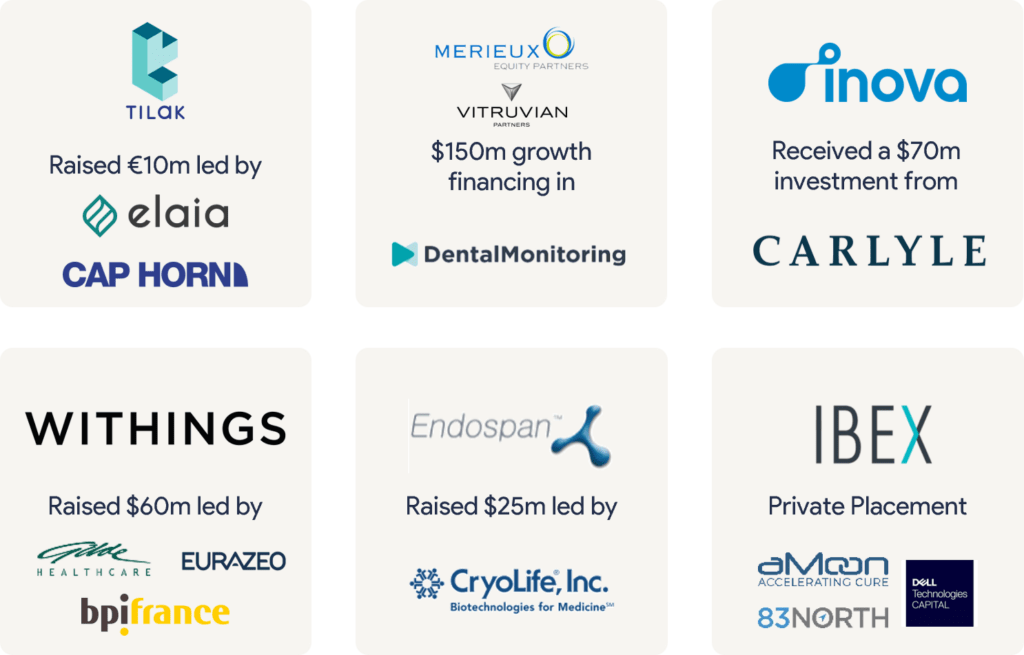

- This is another testimony of Clipperton’s fast-growing track record in the digital health space. Notable recent transactions in the segment include advising Tilak Healthcare on its growth investment by Elaia and Cap Horn, Merieux’ on the $150m financing round of Dental Monitoring at a $1bn valuation, Inova Software on its $70m investment by Carlyle and Withings’ on its $60m round led by Gilde Healthcare, Eurazeo, and Bpifrance.

Our Client

- Founded in 2017 by Athanase Kollias, a former high-level athlete, Kinvent transforms the practice of physiotherapists and fitness trainers through the collection and analysis of biomechanical data.

- Based in Montpellier, the company designs, develops, and manufactures a range of connected devices that instantly measure force, balance, and range of motion through a single application for the sports performance, rehabilitation, and medical industries.

- Kinvent recorded an 80% growth between 2022 and 2023 in a market that is largely underequipped in connected devices. Its 8 sensors, which cover the majority of tests performed in physiotherapy sessions, have attracted more than 14,000 rehabilitation professionals (sports specialists, general practitioners, or those working in nursing homes or post-surgical units), healthcare professionals, and even professional sports clubs spread across 68 countries.

- The company has notably partnered with renowned clubs such as Montpellier Hérault Rugby, the French Athletics Federation, and the New York Mets, boosting the company’s acclaim internationally.

Deal Rationale

- Eurazeo Nov Santé is an international private equity fund dedicated to the development of health sectors in France. Eurazeo acquired a minority stake in the capital alongside the founding president and existing minority shareholders, including Unifund, Sofilaro, BADGE, and Raphaël Varane, among others.

- With this latest investment with Eurazeo, Kinvent is now setting out to conquer the global connected physiotherapy device market, starting with the penetration of the American market. To achieve its ambitions, Kinvent can rely on the health expertise and experience of the Nov Santé team in structuring a rapidly growing company and executing a broad commercial development plan.

- “Our teams are delighted to welcome Eurazeo, a leading investment player, so we can build towards the goal of being the world leader in connected solutions for physiotherapy and sports practitioners together. We are at a structuring stage in our history, in a rapidly expanding market, and have been convinced by the Nov Santé team’s ability to accompany Kinvent’s development, its knowledge of the Health market, and its internal expertise,” says Athanase Kollias, President, and founder of Kinvent.

- “Nearly three years after the fund’s launch and a start on development capital, we are opening a new chapter with our first Growth Equity deal. We are very proud that Kinvent has chosen us as the lead investor. The company’s expertise, its position as a leader and innovator, as well as the quality of its management team convinced the entire Eurazeo team,” adds Arnaud Vincent, Managing Director of the Nov Santé Fund at Eurazeo.

Clipperton’s Health Tech Practice

- This is testimony of Clipperton’s fast-growing track record in the digital health space. Notable recent transactions in the segment include advising Tilak Healthcare on its growth investment by Elaia and Cap Horn, Merieux’ on the $150m financing round of Dental Monitoring at a $1bn valuation, Inova on its $70m investment by Carlyle and Withings on its $60m round led by Gilde Healthcare, Eurazeo, and Bpifrance.

Deal Team

- Antoine Ganancia, Managing Partner

- Capucine Viard, Analyst

- Pierre Pinsault, Analyst

About Clipperton

Clipperton is a leading investment bank dedicated to technology and growth companies. We provide strategic and financial advisory to entrepreneurs, corporates, and top-tier investors in Europe willing to execute transactions such as strategic M&A, private equity transactions, and private placements. Founded in 2003 and with offices in Paris, Berlin, Munich, London, New York, and Beijing, Clipperton has completed over 400 M&A and private placement transactions with fast-growing technology start-ups, blue-chip corporates, and renowned financial investors.