- Clipperton acted as sole financial advisor to Grasp, a media governance & data quality SaaS platform for the advertising industry, on its sale to MiQ, a New York-based programmatic media partner for marketers and agencies, backed by Bridgepoint.

- Grasp will introduce an exciting new route to partner with MiQ across all markets. The company will continue to operate as an independent business unit under MiQ’s ownership and will retain its current brand.

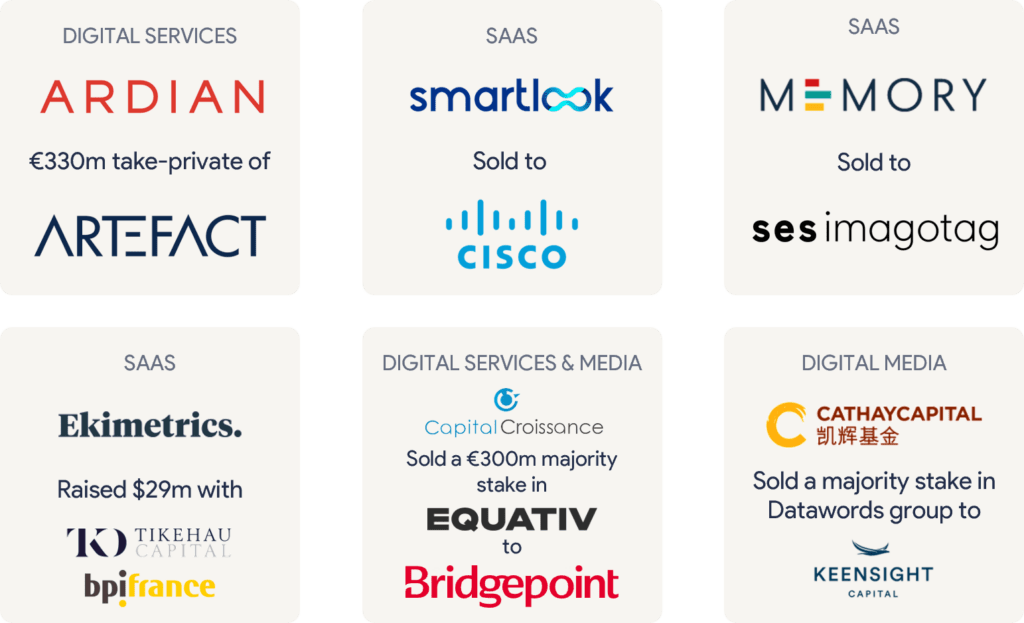

- This transaction illustrates Clipperton’s rich track record in the Martech & Adtech space, with transactions such as the sale of Smartlook to Cisco [NASDAQ: CSCO] earlier in 2023, Ardian’s €330m take-private of Artefact, Brevo’s $160m Series B or Capital Croissance’s majority stake sale in Equativ.

Our Client

- Grasp’s SaaS suite is the world’s first solution to address quality assurance and compliance in the highly complex advertising industry. The company’s products prevent non-compliance and enforce governance frameworks for digital marketing campaigns, eliminating risky & expensive manual errors and saving advertisers millions in potential lost revenue due to overspending or inaccurate data.

- The company’s platform has become a must-have for media agencies and has experienced explosive growth since its inception: Grasp is already used by 8,000 users worldwide, and is a multi-million and profitable business.

- Media agencies, such as Havas Media Group and WPP, as well as leading brands, such as L’Oréal and PepsiCo, leverage Grasp’s quality assurance SaaS suite to save millions in potential digital advertising revenue losses through improved governance & data integrity.

Deal Rationale

- As a globally recognized programmatic managed services partner for marketers and agencies, MiQ has always invested in developing proprietary technology solutions that optimize the media buying experience on behalf of its clients.

- Grasp will introduce an exciting new route to partner with MiQ across all markets. The company will continue to operate as an independent business unit under MiQ’s ownership and will retain its current brand. There will be no change to either company’s organizational structure.

- This marks MiQ’s third significant financial investment to date, as part of its long-standing commitment to making the digital advertising ecosystem and experience better for all advertisers.

- “Grasp consistently advocates for and helps bring operational excellence in digital advertising by empowering all in the media buying process and ecosystem to do the right thing from the very start,” said Pierre-Lou Dominjon, co-founder and CEO of Grasp. “Under the MiQ umbrella, we’ll have even more opportunity to bring strategic advantage, order, and efficiency to media buying processes and advance our shared mission to fuel operational excellence in new and exciting ways.”

Clipperton’s track record in Data Science and MarTech

- This transaction illustrates Clipperton’s rich track record in Martech & Adtech, with many recent landmark transactions such as the sale of Smartlook to Cisco [NASDAQ:CSCO] earlier this year, Ardian’s €330m take-private of Artefact [ALATF], In The Memory’s sale to SES-imagotag [EPA:SESL], Brevo’s $160m Series B, or Capital Croissance’s majority stake sale in Equativ.

- In addition, this new SaaS transaction (the 10th in 2023) underpins Clipperton’s unique positioning for European software companies to assist them with first-class transactions.

Deal Team

- Nicolas von Bülow, Managing Partner

- Marc Schäfer, Executive Director

- Naomi Darko, Associate

Read the press release in French.

About Clipperton

Clipperton is a leading investment bank dedicated to technology and growth companies. We provide strategic and financial advisory to entrepreneurs, corporates, and top-tier investors in Europe willing to execute transactions such as strategic M&A, private equity transactions, and private placements. Founded in 2003 and with offices in Paris, Berlin, Munich, London, New York, and Beijing, Clipperton has completed over 400 M&A and private placement transactions with fast-growing technology start-ups, blue-chip corporates, and renowned financial investors.