- Clipperton acted as the sole financial advisor to Didomi, a leader in consent and privacy management.

- Marlin joins the capitalization table as part of an $83 million investment to support Didomi in accelerating international expansion and positioning itself as the leading digital trust platform globally.

- Didomi acquires Addingwell, a server-side tagging platform, to unlock privacy-first data collection and activation with a proprietary Didomi server-side offering.

- Clipperton had previously advised Didomi on the company’s $40m Series B round with Elephant Partners, Breega, and other financial investors.

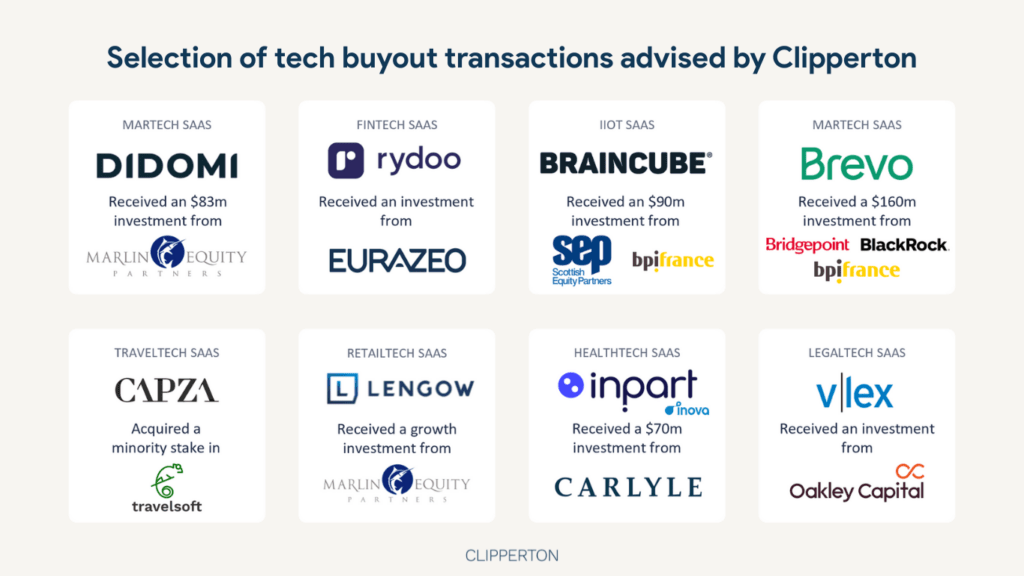

- This transaction further confirms Clipperton’s expertise in advising tech leaders in their buyout transactions, with recent transactions including Rydoo’s LBO with Eurazeo, Braincube’s $90m deal with Scottish Equity Partners, or Travelsoft’s LBO with CAPZA.

Our Client

- Founded in 2017 by Romain Gauthier, Jawad Stouli, and Raphaël Boukris, Didomi offers a SaaS solution that allows organizations to implement great Privacy User Experiences that respect choices and give people control over their data.

- Its Global Data Privacy Solutions are designed to solve today’s data privacy challenges, such as multi-regulation consent management, privacy governance, and the need to provide self-service user privacy journeys, supercharged by flexible integrations, high-grade security standards, and premium support services.

- Active in over 35 countries and relied upon by over 1,500 companies, including Orange, Rakuten, Decathlon, Societe Generale, ING, and many others, Didomi supports businesses across various sectors in strengthening user relationships through clarity, choice, and control.

Deal Rationale

- This anchor investment of Marlin will enable Didomi to further position itself as the Global Data Privacy solution provider, consolidating its product suite and accelerating its international expansion

- The acquisition of Addingwell strengthens Didomi’s conviction that data privacy is more than compliance and has become a strategic, core business topic for leading organizations looking to enhance data sovereignty and effectiveness.

- A fast-growing, major player in the market, Addingwell supports over 1,000 clients in their server-side tagging implementation, optimizing their data strategies to maximize marketing and advertising ROI in a compliant manner.

- “The acquisition of Addingwell represents a significant milestone in our journey, reflecting a commitment to driving innovation and delivering enhanced value to our customers, at a time when companies need to adapt to a demanding privacy context with the right approach and partner for their data strategy. This acquisition will consolidate Didomi’s position as a disruptive and ambitious force within the Data Privacy and Consent Management sector.”, commented Romain Gauthier, Co-Founder and Chief Executive Officer at Didomi.

- Marlin Equity Partners, a global investment firm with offices in Paris, London, and Los Angeles, approximately $10 billion in capital commitments, and nearly 260 acquisitions under its belt, will act as a trusted partner for Didomi’s next phase of development.

From Venture Capital to Private Equity

- The exit landscape for VC-backed startups has undergone a substantial transformation over the past decade, notably thanks to the emerging trend of what we like to call “VC-to-PE deals”. While exits to PE funds made up just 8% of total exits for VC-funded companies between 2006 and 2010, that figure has surged to a whopping 24% for the years 2021 to 2024.

- This transaction confirms this trend and further shows Clipperton’s expertise in advising tech leaders in their buyout transactions, with recent transactions including Rydoo’s LBO with Eurazeo, Travelsoft’s LBO with CAPZA, or Braincube’s LBO with Scottish Equity Partners.

Deal Team Clipperton

- Antoine Ganancia, Managing Partner

- Martin Vielle, Partner

- Ghislain de Buchet, Vice President

- Naomi Darko, Vice President

- Julie Bayle de Jessé, Analyst

About Clipperton

Clipperton is a leading pan-European investment bank dedicated to technology and growth companies, with offices in Paris, Berlin, Munich, London, and Amsterdam, as well as partnerships in the USA, China, Italy, and Spain. We provide strategic and financial advisory to entrepreneurs, corporates, and top-tier investors in Europe who are looking to execute strategic M&A, private equity, private placements, and debt financing transactions. Founded in 2003, we have completed over 500 deals with fast-growing technology companies, blue-chip corporates, and renowned financial investors.