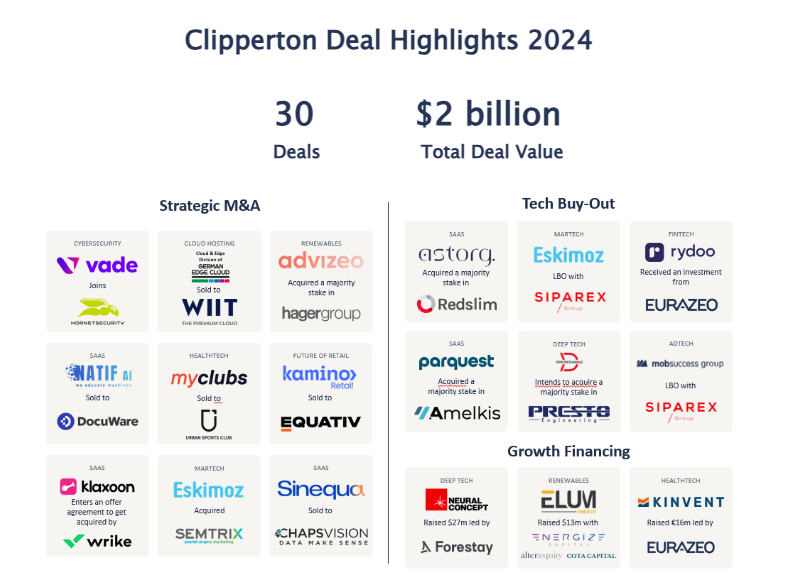

Clipperton delivered another strong year in 2024, undeterred by macroeconomic headwinds in Europe. Over the past twelve months, we advised on over 30 high-profile tech deals, totaling $2 billion in deal value and featuring a diverse mix of strategic M&A deals for fast-scaling clients, tech buyouts, and growth financings.

Inflation under control, profitable growth premium: Is ‘the best yet to come’ for tech in 2025?

From a market perspective, 2024 was a challenging year, especially in Continental Europe. However, a few recent developments have brought a more positive outlook: inflation and interest rates appear to be under control, while high liquidity levels persist, maintaining the strong appeal of private equity and venture capital. Meanwhile, technology – AI, software, cybersecurity, and renewable energy – drives structural growth across the real economy.

These trends are reflected in the recovery of valuation levels, evident in the European mid-market and in the SaaS sector, where valuations now average 7x projected sales over the next 12 months. Notably, the focus is shifting toward profitable growth in the SaaS industry, with top-performing companies – those meeting the ‘Rule of 40’ – commanding multiples exceeding 10x, and even higher in some cases.

Clipperton Deal Highlights 2024

Fueled by a constant appetite from both financial sponsors and trade buyers, we were happy to assist some of the leading Software companies in Europe – our largest practice accounting for around 60% of all deals. Since 2020, Clipperton has facilitated over 100 transactions in the Software space, over half of which were buy-out deals.

In 2024 alone, we contributed to several noteworthy deals:

Trade Sales:

- The merger of two cybersecurity leaders in Europe, French Vade Secure and German Hornetsecurity;

- The sale of French enterprise search engine company Sinequa to ChapsVision, a leader in AI-enhanced data processing;

- The sale of German document management company natif.ai with Japanese-American leader Ricoh (Docuware).

Private Equity Deals (Sell-Side and Buy-Side):

- Rydoo, the fast-growing international expense management software provider, received an investment from Eurazeo;

- Eskimoz welcomed Siparex ETI as a new minority shareholder;

- The Mobsuccess Group received an investment from Siparex Midcap;

- Astorg acquired a majority stake in Redslim, a data management services provider;

- DENTRESSANGLE Capital acquired a majority of the capital of leading ASIC’s designer and producer, Presto Engineering.

- Amelkis’, the SaaS solution for reporting and accounting consolidation, LBO with Parquest;

Each in their respective field, these major European players will be able to solidify their leadership through both organic and external growth, thanks to the resources provided through these new transactions.

Aside software, tech-enabled services and Martech have been an important part of our 2024 performance with an accelerating digitalization of large corporates as illustrated by the sale of Kamino Retail (retail media) to Equativ, backed by Bridgepoint, along the LBOs of Mobsuccess and Eskimoz (see above).

Looking Ahead

We enter 2025 confident that our combined sector expertise, built since 2003, and transactional capabilities will meet the growing demand from our clients for innovative funding solutions.

We are also deeply grateful for our clients’ trust and our teams’ dedication.

For an in-depth exploration of our European tech deals in 2024 and our prior transactions, click here.

Expanding Leadership and Capabilities: Launch of our Debt Advisory Practice and Expanded European Coverage

To secure our future growth, we have strengthened our senior leadership team through targeted hires and key internal promotions:

The rise of leveraged PE deals in the tech sector prompted us to launch our dedicated Debt Advisory practice in the summer of 2024, led by our new Partner Laurence de Rosamel, bringing nearly 20 years of European expertise, and joined by William Poirson as a Director.

We have enhanced our client coverage capabilities throughout Continental Europe, with Steffen Boode joining the team as a Senior Advisor and local partner in the Netherlands for the Benelux region.

Wael Abou Karam and Karim Mekouar were promoted to Director last summer in our Paris office. Both have consistently demonstrated exceptional leadership, dedication, and impact within our team.

We have further welcomed 9 new talents to our team in 2024!

Other Corporate News

Clipperton is ranked as a leading TMT advisor in M&A and Private Equity in France

We are honored to once again be recognized in the leading categories M&A (TMT and Small & Mid-Cap), PE (Growth Financing & LBO Small-Cap), and Health & Pharmaceutical Industry M&A in the Leaders League 2024 ranking.

A heartfelt thank you to our clients, partners, and friends for your continued trust, and to our entire team for their exceptional dedication and expertise.

You are in the driving seat of our positive impact

At Clipperton, we take pride in our commitment to supporting key innovators in their strategic and financial growth. In the spirit of starting the New Year with impact, we made the choice to support organizations that are positively transforming the world.

Click on this link and select from three thoughtfully chosen charities. Thank you for your participation!

Unveiling of our new corporate visual identity

As we celebrated over 20 years of dedication and success, we were proud to launch our new brand identity.

Our new visual identity is more than just a refreshed look: it symbolizes Clipperton’s evolution and reinforces our status as a European leader in advising tech scale-ups. This new brand platform reflects our modern, dynamic, and forward-thinking approach while honoring the legacy and core values that have been the foundation of our success.