Tech Resilience and Revival: From Disruption to Maturing Stability

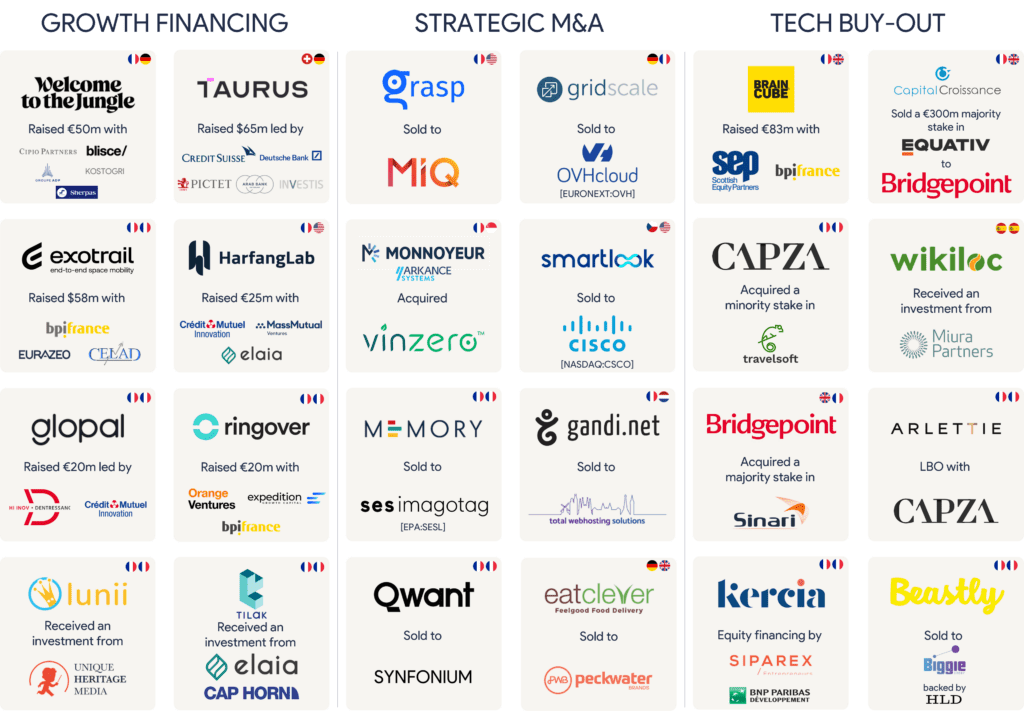

Clipperton demonstrated its ability to navigate challenging market conditions, in another successful year with a record number of transactions. In 2023, Clipperton advised on 30 high-profile tech deals worth over $3 billion with a healthy mix between growth financing for high-growth clients, tech buy-out deals, and strategic M&A.

From a market perspective, the new global disorder that followed the pandemic saw stock market valuations plummet with the return of inflation and rising interest rates, causing a certain tech bubble to burst as a domino effect. However, the sector has returned to a rather promising cruising speed – admittedly more cautious, and less exuberant, but also signaling a form of maturity, after the fever of 2021/22. This trend towards a return to normality can be seen in the SaaS sector, where by mid-2023 listed companies were back to valuations of around 8x sales, in line with the trend seen in the years before Covid.

2023 thus seemed to confirm a turning point in the small and mid-market tech sector, with an increasing emphasis on profitability and risk mitigation, rather than on growth at all costs. It remains to be seen how companies will manage the transition back to sanity, but so far the activity of Clipperton, with 30 deals in 2023, roughly half of them with industrial companies and the other half with investment funds, indicates the solidity of the sector.

The digitization of human activity (both people and businesses) via software and data generation and processing (including the use of AI) continues unabated. This transformation of society, aimed at efficiency gains, is generating increased needs in terms of storage, analysis, and security, and just as many opportunities for innovation – and investment – and is already shaping new uses. A number of recent deals, including in France, are emblematic examples of this: OVHcloud/Synfonium in Cloud Hosting, Tilak Healthcare in connected Healthcare, HarfangLab in Cybersecurity, Exotrail in New Space, Taurus in Blockchain, Arlettie in responsible E-Commerce, and so on. Little by little, European leaders are emerging.

The forthcoming year presents a landscape teeming with innovation, enticing investment prospects, and the continued upward trajectory of tech enterprises. This sets the stage for a promising journey towards sustainable growth and the ongoing evolution of technology.

We are immensely thankful for the enduring trust of our clients and the unwavering dedication of our team members. For an in-depth exploration of the tech deals we advised in throughout Europe in 2023 and our prior transactions, click here.

Clipperton Deal Highlights 2023

New Partner Promotions

Olivier Combaudou, Andreas Hering, and Martin Vielle were welcomed to the firm’s partnership. Dr. Nikolas Westphal, Antoine Ganancia, and Thomas de Montille have been promoted to Managing Partner, marking a significant milestone in the organizational structure.

Clipperton’s leadership team is now composed of 10 Partners and over 50 experienced professionals based out of Paris, Berlin, and Munich.

Other Corporate News

Clipperton is ranked as the leading TMT advisor in M&A and Private Equity in France

We are very proud to be once again ranked in the leading categories M&A (TMT and Small & Mid-Cap) and PE (Growth Financing & LBO Small-Cap) in the Leaders League 2023 ranking.

A big thank you to our clients, partners, and friends for your trust and to our entire team for their professionalism and dedication.

You are in the driving seat of our positive impact

At Clipperton, we take pride in our commitment to supporting key innovators in their strategic and financial growth. In the spirit of starting the New Year with impact, we chose to support organizations that are positively transforming the world.

Click on this link and select from three thoughtfully chosen charities. Thank you for your participation!

Research paper: The Journey from VC to PE

Clipperton published the research paper “The Journey from Venture Capital to Private Equity: A Guide for Tech Startups”.

Building on our extensive experience and dialogues within both the VC and PE sectors, this paper delves into the unique challenges and adaptations required, offering insights, strategies, and actionable tools to help startup founders and VC firms successfully navigate the intricacies of the PE world.

Celebrating 20 Years of Clipperton

Celebrating 20 Years of Clipperton

Clipperton celebrated its 20th anniversary in 2023! Started as a 2 person team, and now a group of over 50 professionals who have completed over 400 transactions, Clipperton looks forward to the next phase of growth in the European tech market.

We were happy to take a moment to reflect and celebrate with our clients, partners and friends at the Centre Pompidou during a festive evening.