- Clipperton acted as the sole financial advisor to the shareholders and the management of Gandi on its acquisition by Total Webhosting Solutions (TWS), forming a new entity, Your.Online. This mission was carried out in the context of the sale of Gandi by Montefiore Investment, majority shareholder since 2019.

- The merger of the two companies, which share a similar DNA and entrepreneurial values, will create a new group, Your.Online. This new European online services platform is dedicated to helping companies of all sizes develop and grow online. Your.Online will serve over one million clients across Europe and the United States.

- Gandi’s sale to TWS is a landmark transaction in the web hosting space, which was made possible by the development and acceleration of Gandi’s growth over the past 4 years. It is also a testament to Clipperton’s expertise in the cloud hosting and domain name segment after advising Dan on its sale to GoDaddy, NBS System’s sale to Oceanet Technology, or Ikoula’s sale to Sewan.

Our client

- Gandi is a domain name registrar, a web hosting service, and a provider of email and SSL certificates whose ambition is to make the Internet accessible to all.

- Founded in 2000, the company now has 150 employees across 3 continents and 350,000 customers. Backed by Montefiore Investment and M80 since 2019 and under the leadership of its founder and CEO, Stephan Ramoin, the company has continued its profitable growth trajectory and is growing its revenues by an average of 10% per year to exceed €50m by 2022. In parallel, its EBITDA has more than doubled.

Deal Rationale

- Clipperton acted as the sole financial advisor to the shareholders and the management of Gandi. This mission was carried out in the context of the sale of Gandi by Montefiore Investment, majority shareholder since 2019.

- Since its foundation in 2017, Total Webhosting Solutions has united and empowered great brands across Europe to build a leading pan-European web hosting group. Other companies that operate under the umbrella of TWS include Yourhosting, Versio, RealHosting, Reviced Cloud Services.

- Your.Online was formed to reflect the true partnership between Gandi and TWS and represent the joint ambition to continue expanding their offering beyond domain names and webhosting towards a world of online possibilities.

- Stephan Ramoin, who will remain involved through his non-executive position as Chairman of Your.Online’s strategic committee stated: “In creating Your.Online, we are ensuring that Gandi remains autonomous while partnering with like-minded people. Montefiore’s support over the past four years has enabled us to become a leader in our market, and this new stage of development will allow us to improve our proposals to clients and challenge the status quo, thanks to the complementarity of our services and positions.”

Clipperton’s expertise in the cloud hosting space

Gandi’s sale to TWS is a landmark transaction globally in the web hosting space, which was made possible by the development and acceleration of Gandi’s growth over the past 4 years. It is also testament to Clipperton’s expertise in the cloud hosting and domain name segment after advising Dan on its sale to GoDaddy, NBS System’s sale to Oceanet Technology or Ikoula’s sale to Sewan.

M&A Strategic Sell-Side in Tech

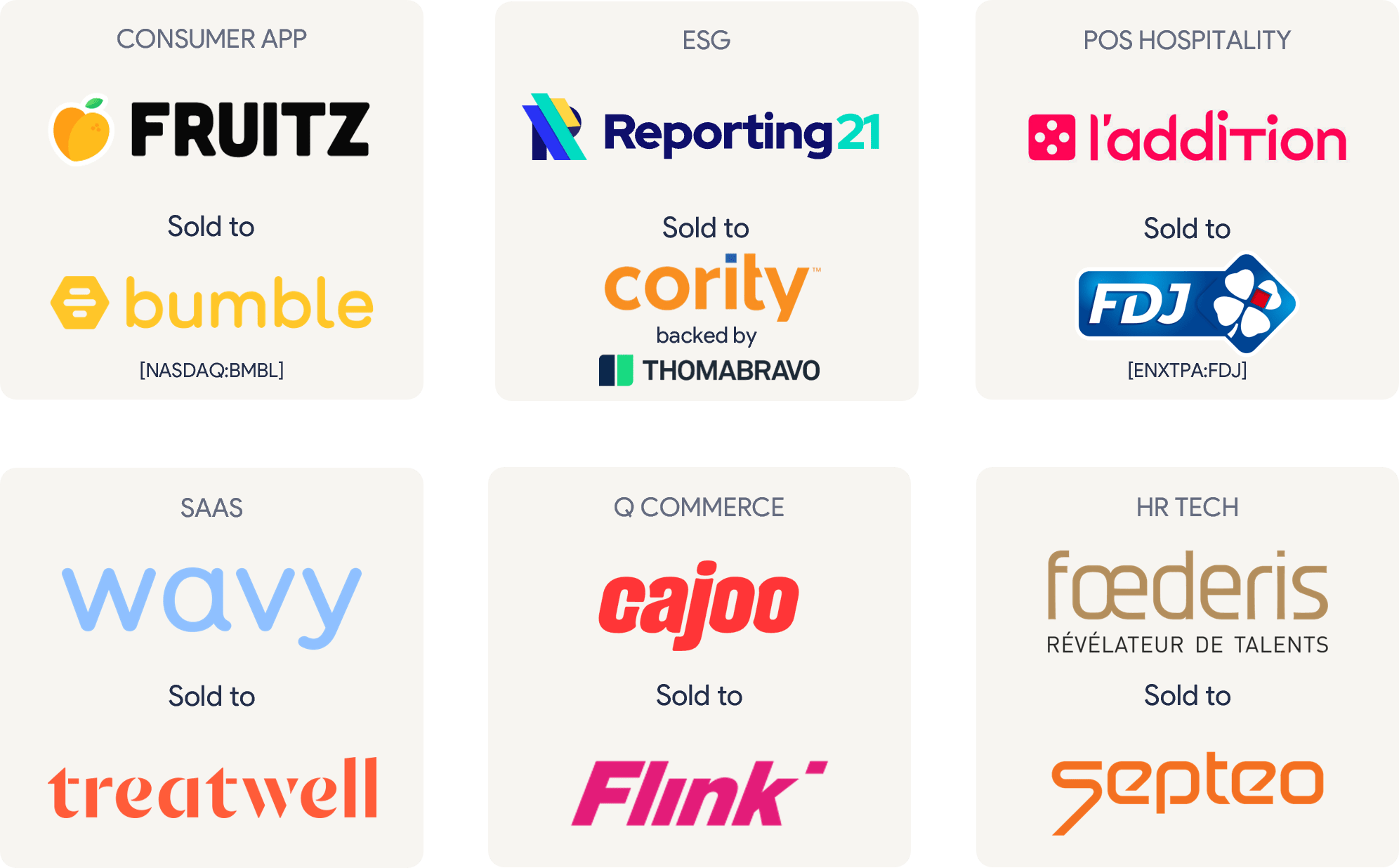

After acting as a financial advisor on several strategic sell-side deals recently (eleven in the past twelve months), this transaction only confirms Clipperton’s ability to advise tech disruptors in finding the best-suited buyer.

Deal Team

- Nicolas von Bülow, Managing Partner

- Olivier Combaudou, Partner

- Simon Boucher, Analyst

About Clipperton

Clipperton is a leading investment bank dedicated to technology and growth companies. We provide strategic and financial advisory to entrepreneurs, corporates, and top-tier investors in Europe willing to execute transactions such as strategic M&A, private equity transactions, and private placements. Founded in 2003 and with offices in Paris, Berlin, Munich, London, New York, and Beijing, Clipperton has completed over 350 M&A and private placement transactions with fast-growing technology start-ups, blue-chip corporates, and renowned financial investors.