- Clipperton and Natixis Partners acted as financial advisors to Astorg on its majority acquisition of Redslim, a Pan-European data management company that is leveraging its proprietary platform to harmonize and aggregate fragmented databases.

- Thanks to this new partnership with Redslim, Astorg will support the company’s growth, including a plan to accelerate R&D and platform investments and drive growth beyond Europe and existing verticals.

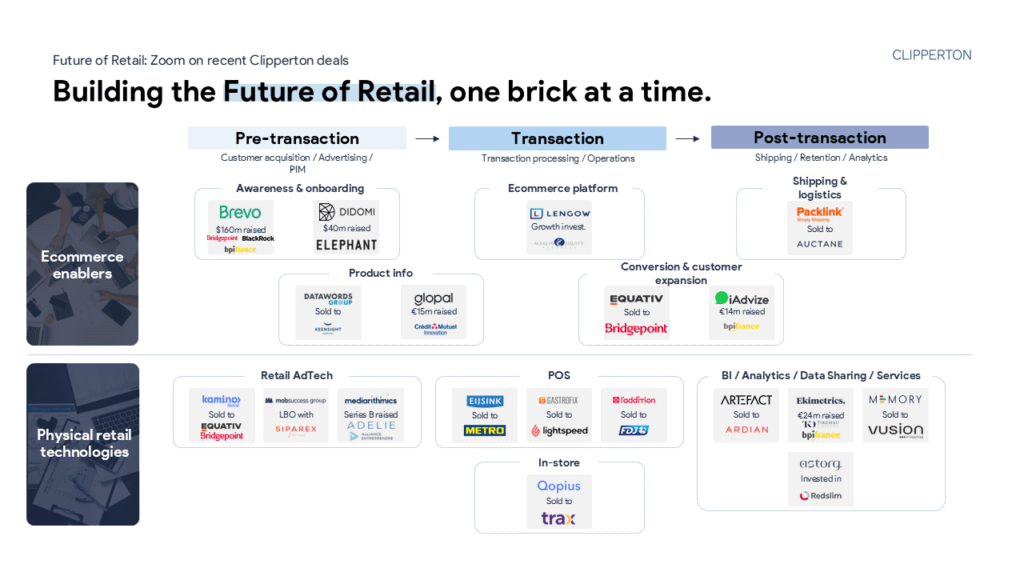

- This deal highlights Clipperton’s proven expertise in advising innovative companies that drive the retail industry’s evolution through advanced technologies. Clipperton has advised several players digitizing retail along the value chain, may it be software players or tech-driven service providers. Recent transactions include Mobsuccess’ LBO with Siparex Midcap, the sale of Kamino Retail to Equativ, and In The Memory’s sale to VusionGroup (formerly named SES-imagotag).

About Redslim

- Redslim, founded in 2013 and based in Zug, Switzerland, provides data management services, leveraging a proprietary technology platform, and focusing on Consumer-Packaged Goods and Consumer Healthcare segments.

- With over 100 employees, Redslim aggregates and optimizes data consumption for over 30 global organizations. The company has been backed by Andera Acto since the beginning of 2023.

Deal Rationale

- Thanks to this new partnership with Redslim, Astorg will support the company’s growth, including a plan to accelerate R&D and platform investments and drive growth beyond Europe and existing verticals.

- The investment will be part of Astorg’s Mid Cap portfolio, its sixth portfolio company and the third in software and technology. Redslim has been growing its sales by 30% to 40% every year for the past four years, reaching around €13 million in 2023, according to the estimates, and counting on nearly €20 million this year and €25 million in 2025.

Future of retail – Clipperton’s strong expertise in advising industry disruptors

This deal highlights Clipperton’s proven expertise in advising innovative companies that drive the retail industry’s evolution through advanced technologies. Clipperton has advised several players digitizing retail along the value chain, may it be software players or tech-driven service providers. Recent transactions include Mobsuccess’ LBO with Siparex Midcap, the sale of Kamino Retail to Equativ, and In The Memory’s sale to VusionGroup (formerly named SES-imagotag)

Clipperton has proven its capability to support retail enablers on a wide spectrum of capitalistic challenges that include Growth Financing, strategic M&A, and PE Growth transactions on both sell- and buy-sides.

Clipperton’s extensive track record with tech buy-out transactions

- This transaction marks the 13th tech buy-out deal of Clipperton over the last 12 months, with recent transactions such as Eskimoz’s LBO with Siparex Midcap or Presto Engingeering’s LBO with DENTRESSANGLE Capital.

Deal Team Clipperton

- Nicolas von Bülow, Managing Partner

- Olivier Combaudou, Partner

- Lucas Pingard, Vice President

- Camille Servant, Analyst

Deal Team Natixis Partners

- Driss Mernissi, Managing Director

- Pierre Ruaud, Managing Director

- Dorian Cherruault, Associate

- Jules Barlot, Analyst

About Clipperton

Clipperton is a leading investment bank dedicated to technology and growth companies. We provide strategic and financial advisory to entrepreneurs, corporates, and top-tier investors in Europe who are willing to execute transactions such as strategic M&A private equity transactions, and private placements. Founded in 2003 and with offices in Paris, Berlin, Munich, London, New York, and Beijing, Clipperton has completed over 400 M&A and private placement transactions with fast-growing technology start-ups, blue-chip corporates, and renowned financial investors.