- Clipperton and Natixis Partners acted as financial advisors to Eskimoz in their acquisition of German-based Semtrix.

- Eskimoz, a Martech leader specializing in web traffic acquisition (SEO, SEA, Content, Data) has acquired Semtrix, a German leader in SEO services based in Düsseldorf, with 50 employees.

- Philippe Charbonnier, Managing Director at Natixis Partners, led the debt financing process of the transaction.

- Following the successive takeovers of Sembox in Italy and Digital Uncut in the UK, and a successful organic expansion in Spain, Eskimoz reinforces with Semtrix its pan-European leading position in marketing technology.

Our Client

- Founded in 2015 by Andréa Bensaid and backed by Momentum Invest since 2020, Eskimoz is the one-stop shop for web traffic acquisition, providing tech-enabled services (SEO, SEA, Content Creation, Data) to scale-ups and blue chips aiming to boost their organic growth.

- Eskimoz brings an innovative response to the complex challenges of digital commerce leveraging data, AI, and operational excellence.

- Eskimoz serves c. 1000 customers in a wide range of sectors, from luxury goods to tech and real estate. The group recorded consolidated sales of c. 30 million euros in 2023, undergoing strong growth.

Deal Rationale

- “With offices in Paris, Lyon, Bordeaux, Brussels, Madrid, Milan, London, and now in Düsseldorf, we can support our customers all over Europe with native consultants” explained Andréa Bensaid, CEO and Founder of Eskimoz.

- Jan-Nicolas Kulh, Founder of Semtrix, noted: “Partnering with Eskimoz marks a strategic evolution for Semtrix. Our strong foothold in Germany, combined with Eskimoz’s extensive network, elevates our ability to offer an even more international and data-driven client acquisition strategy to our clients.”

- Alain Cochenet, Founding Partner at Momentum Invest, commented: “With this acquisition, Eskimoz further asserts its unique ability to consolidate the market at the European level and to continuously reinforce its leadership position. We are particularly grateful to Clipperton and Natixis Partners for their support in this transaction.”

Clipperton’s track record in the martech industry

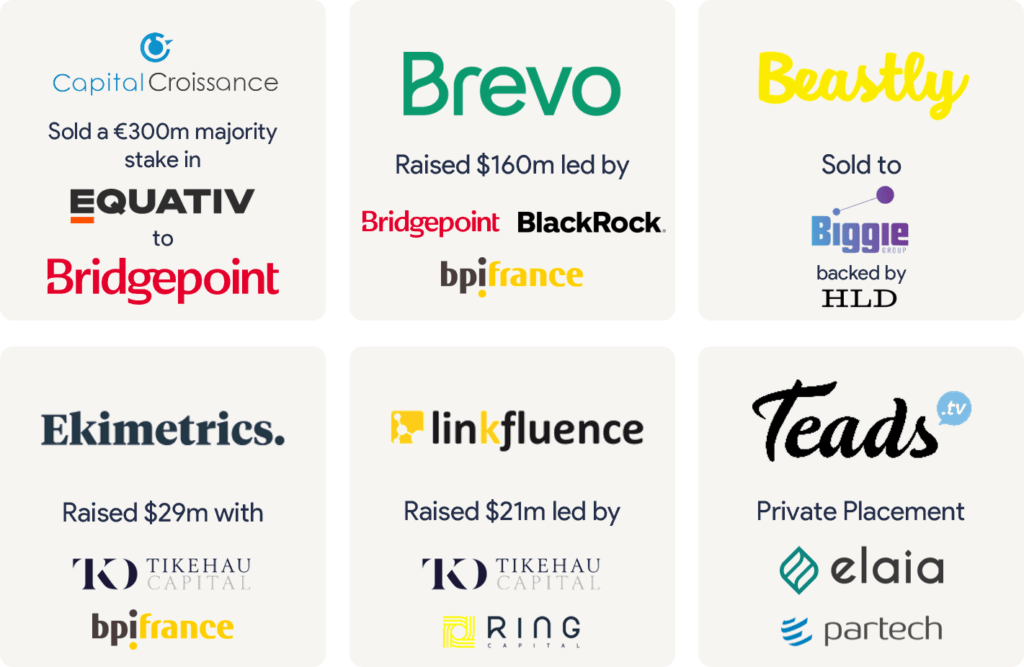

This transaction confirms Clipperton’s expertise in the martech industry, with previous transactions such as Capital Croissance’s €300m majority stake sell in Equativ to Bridgepoint, Brevo’s $160m fundraising led by BlackRock, Bridgepoint and Bpifrance, and Ekimetrics’ $29m growth financing with Tikehau Capital and Bpifrance.

Deal Team

- Thomas de Montille, Managing Partner

- Philippe Charbonnier, Managing Director at Natixis Partners

- Marc Schäfer, Executive Director

- Lucas Pingard, Vice President

- Simon Boucher, Associate

- Pierre Pinsault, Analyst

Read the French press release here.

About Clipperton

Clipperton is a leading investment bank dedicated to technology and growth companies. We provide strategic and financial advisory to entrepreneurs, corporates, and top-tier investors in Europe willing to execute transactions such as strategic M&A, private equity transactions, and private placements. Founded in 2003 and with offices in Paris, Berlin, Munich, London, New York, and Beijing, Clipperton has completed over 400 M&A and private placement transactions with fast-growing technology start-ups, blue-chip corporates, and renowned financial investors.